Cash Posting

Cash Posting/Charge Posting

- Posting of the details contained in the EOB

- Should post the relevant charge in the appropriate patient’s account

- Initiate the process for the denied claims.

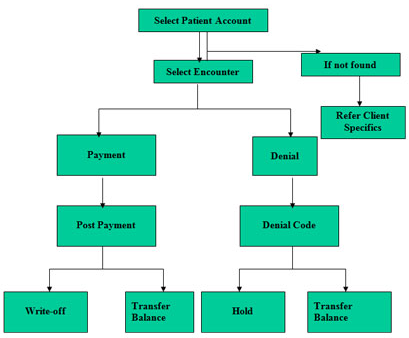

Payment Entry Process - Flowchart

CASH POSTING OR PAYMENTS

When a claim has been processed and paid, the amount paid will have to be applied to the amount charged for individual patient’s treatment in the Medical Billing Software. This makes it possible for the billing office to track the payments received from different angles. The billing office would want to track the payments received based on differed criteria.

Cash posting or the correct application of payments to their respective charges in the medical software is very important as any wrong posting may result in wrong accounting. Cash postings will be done based on checks and Explanation of Benefits (EOBs) that are sent by the insurance companies and the checks sent by the patients. An EOB is usually sent with a check and explains what charges have been paid, for which patient, and for which Date of Service how much was paid. In case of a denial, and EOB alone is sent and it explains which charge has been denied and for what reason. The EOBs will be used to verify any discrepancies from the expected payment. EOBs are the only hard-copy evidence the billing office has of the insurance company receiving and processing the claims sent to them and will have to be filed carefully for future reference.

Before getting deep into payments let us understand a few terminologies that we may come across in a typical EOB.

Billed Amount. This is the amount charged by a physician as a compensation for his services. The billed amount will reflect on the claim against the treatment that was performed.

Allowed Amount. Most insurance companies have a fixed payable amount for each of the different services performed by the physicians. They fix this amount based on various in-house calculations like cost of the treatment, geographical location of the practice, average charge of all physicians for that procedure etc., Insurance companies will pay only their allowed amount regardless of how much the physician bills.

Write-off: When the physician’s billed amount is more than a participating insurance company’s allowed amount, the insurance company will pay it’s allowed amount and the difference between the billed and the allowed amount will be written off or adjusted.

WRITE OFF=BILLED AMOUNT – ALLOWED AMOUNT

Participating/Non-participating: A physician can either have a participating or a non-participating relationship with an insurance company. A participating relationship is one in which the physician accepts a payment of the insurance company’s allowed amount as full payment, for any of that insurance company’s beneficiaries. This is regardless of how much the physician billed for his services. If the physician bills over the allowed amount, the insurance company pays the allowed amount and the difference is written-off. The patient cannot be billed for the balance unless the insurance company’s eob specifically says so. A doctor billing a non-participating insurance company will also get paid according to their allowed amount. The difference here is that the doctor can bill the patient for the balance.

With an example let us see how a participating and non-participating physician gain or lose when collecting from an insurance company. The insurance company taken in this example is Medicare. As a policy Medicare pays 80% of the allowed amount in the case of a participating provider. They pay 80% on 95% of the allowed amount in the case of a non-participating provider. Dr.Par is participating and Dr.Non-par is not participating with the insurance company.

|

Billed Amount

|

Allowed Amount

|

Amount Paid

|

Amount Due From Patient

|

|

| Dr.Par |

$75

|

$70

|

$56

|

$14

|

| Dr.Non-Par |

$80.50

|

$70

|

$53.20

|

$27.30

|

Dr.Par is willing to accept the allowed amount. His patient owes only $14 because the doctor has agreed to accept $70 as the full amount allowed. He receives 80% of $70 i.e., $56 from the insurance company and must collect $14 from his patient. The provider will write off the difference between the billed amount and the allowed amount, which is $5.

Dr.Non-par is able to charge a different fee. The insurance company will pay only 80% of 95% of the allowed amount. In other words, he loses 5% of the allowed amount by not being a participating provider. In this example Dr.Non-par is entitled to

95% of $70 = $66.50

95% of $70 = $66.50

He must therefore collect $27.30 from his patient.

Deductible: This is an amount paid by the subscriber for medical expenses, before his coverage starts paying. Depending on the type of coverage, the patient will have to pay $500 or $1000 for his medical treatment before his insurance company starts paying on his behalf. Some insurance companies have a yearly deductible, which means that every calendar year the patient would be responsible for a certain amount of money before their insurance starts paying their medical bills for that year. Other insurances have a lifetime deductible, which means that the patient will have to pay for his treatment until a certain limit (like $5000) and then the insurance would start paying till his coverage is valid.

Co-insurance/co-payment: A primary insurance company makes a payment on a claim to a participating physician. They instruct the physician’s office to collect a specified amount from the secondary insurance or the patient. This specified amount is called a co-insurance or co-payment.

Balance bill: When a non-participating primary insurance co. pays a part of a claim, the balance on the claim can be billed to the patient or secondary ins. Regardless of the non-participating ins. Allowed amount.

Out of pocket Expenses: A medical bill or part of medical bill paid by patient out of his pocket because of non payment of his insurance company is called Out of pocket expenses. Deductible, co-pay, co-insurance and balance bills are “Out of pocket expenses”.

Contract Maximum: Some insurance companies have a maximum payable amount on certain illness or policies. The total amount payable on a patient’s policy based on his/her contract is called contract maximum.

Coordination of Benefits: This is a provision regulating payments to eliminate duplicate coverage when a claimant is covered by multiple group plans – an insurance company takes into account benefits payable by another carrier in determining its own liability.

Risk: It is the chance or possibility of loss (also could be the possibility of loss associated with a given population)

Retention/Discount: Retention is basically withhold of a part or full payment by the insurance company for some specified reasons which may be to compensate overpayments done earlier or any other reasons.

Authorization/Referral: Some insurance contracts require an authorization or a referral for patients who have met a specialist. This should come from the primary care physician, stating his diagnosis and reasons for sending the patient to meet a specialist. This referral acts as a kind of a second opinion on the patient’s medical condition. It also helps in keeping the insurance co.’s costs down by filtering the number of patients who really require a specialist’s supervision.

Pre-authorization/pre-certification: Some insurance contracts require a pre-authorization/pre-certification for specific services. Pre-certification is a method of pre-approving all elective hospital admissions, surgeries, and other services as required by an Insurance company. Approval is essential to receiving payment.

For ex: If a patient comes in for an eye surgery and if his insurance card says that any treatment related to the eye surgery needs to be pre-certified.

Fee Schedule: A list of all medical procedures and their respective allowed amounts for any INS co is that INS company’s “FEE SCHEDULE”.

Offset: When an Insurance company had paid excess amount in the previous EOB to the provider or the billing office it will adjust that excess amount in the next EOB they sent (by reducing the exceeded amount). Thus the process of adjusting the excess amount paid by the insurance to the provider in their next EOB is called “OFFSET”.